Enter your door number. Link documents attested by a gazetted officer. Your Mobile Number - Verification Pending! We will complete Email Verification Process in next 24 to 48 Hours. We will complete Verification Process in next 24 to 48 hours. Your Email Id Verification Pending! The search result is displayed with the details of the property like door number, PTIN, and the amount of property tax that you must pay.

| Uploader: | Yozshutaur |

| Date Added: | 7 October 2004 |

| File Size: | 39.1 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 94182 |

| Price: | Free* [*Free Regsitration Required] |

The search result will display the PTIN for the property.

Ghmc property tax payment receipt

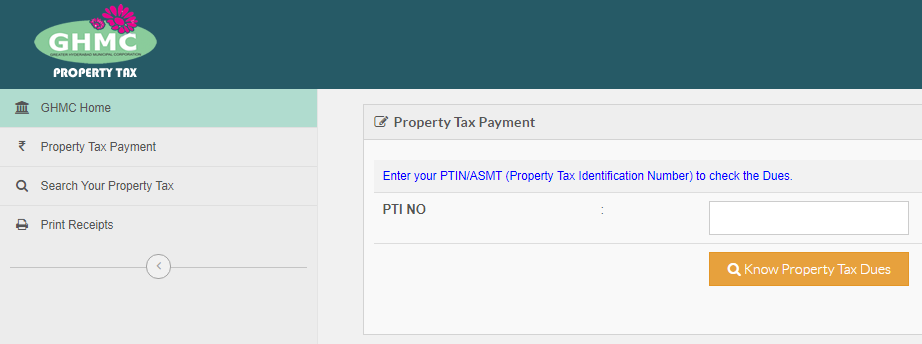

You will get a payment confirmation once your GHMC property tax payment is successful. To pay the property tax GHMC online: Paiv Villas in Hyderabad Starting from 50 Lakhs Location of the building.

Follow the steps given below to find your PTIN: Choose any of the GHMC property tax payment options: In case it's a residential property the prevailing rates will, in case of non-residential a fixed price.

The finance minister, Piyush Goyal had proposed propertt property owners can enjoy the benefits of self-occupied properties up to two residencies. There will be no change in the PTIN only the amount of property tax will increase.

GHMC Property Tax

Property owners are liable to pay property tax. It is in turn used for the maintenance of public facilities as thmc of the locality, construction, and maintenance of the parks, drainage facility, infrastructural developments like extension and construction of paif, flyovers, foot-over bridges, and many more.

Initially, property tax is administrated by the state government and later on assigned to different municipalities. Property Tax is a significant source of revenue for any state governments.

The detailed procedure is explained later in the article. Link documents attested by a gazetted officer. You can choose from any of the payment options: The Self-Assessment Form is launched. Click this link to verify your property tax Hyderabad online for dues.

The list of documents you must submit along with your application are as follows:. MRV is notified by GHMC and is based on zones or locality, the category of the building, type of construction, and usage. Submit your application to the Deputy Commissioner.

The search results display the payable tax details. Copy of the building sanction plan.

Importance of GHMC Property Tax (PTIN) For Hyderabad Residential Properties

Calculate the plinth area of your property. Please check your Inbox or spam box to complete Email verification.

The details of the property like door number, PTIN, and the amount of property tax that you must pay will display. For the online process, you can visit the website for GHMC taax tax online payment. You need to submit your application to the Deputy Commissioner.

The search result displays the PTIN of the property. Enter your door number. The landlord is liable to pay GHMC tax on poperty yearly basis. Did not received Verification Link? The entire process of assessment, issue of special notice, issue of annual demand notice, and collection is fully computerized.

Click Search Property Tax.

No comments:

Post a Comment